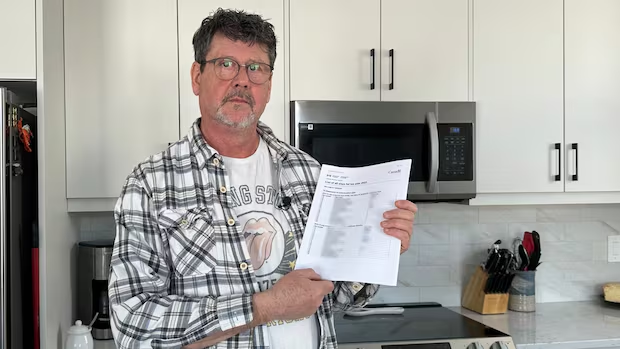

As the 2025 tax season approaches, Bill Bisson is stuck in tax limbo, still waiting for the Canada Revenue Agency to resolve a $3,471 penalty stemming from his 2023 return — a charge he and his tax adviser say is an obvious CRA error.

“It’s frustrating, it has created a lot of stress for me,” said Bisson, who lives in Beaver Bank, N.S., just outside Halifax. “It just keeps hanging over my head.”

Bisson is one of a number of Canadians enduring long and frustrating waits for the CRA to address issues involving their tax returns, including mistakes they say the agency made.

- Got a story you want investigated? Contact the Go Public team

On its website, the CRA warns of processing delays that could add months to waits for several key services, like certain disputes with the agency, tax adjustments — including for the disability tax credit — and requests to waive CRA-imposed penalties.

Bisson is disputing his penalty because his tax adviser determined it was the result of a CRA error — the accidental doubling of one of his income slips when the agency assessed his 2023 taxes.

“I’ve done nothing wrong,” said Bisson. “I submitted all my taxes.”

The Canada Revenue Agency (CRA) is warning about processing delays for several key services involving Canadians’ tax returns. Some stuck in the backlog say they’re stressed and desperate for resolution.

In March 2025, his adviser filed an official request for the CRA to waive the penalty. The agency says on its website that it aims to resolve these types of cases within six months, but it warns the current wait could be up to 12 months or longer.

Bisson has already waited ten months with no indication when his case will be addressed. Meanwhile, the penalty he’s disputing has grown from $3,471 to $3,836 due to mounting interest.

“I just want to get this resolved,” said Bisson, adding that the growing bill sometimes keeps him up at night.

“The wheels start turning, and you can end up losing two or three hours of sleep.”

Taxpayers ‘in tears’ over dispute backlog

Financial and tax adviser Helena Ferreira says many of her clients have also encountered long delays to resolve their disputes with the CRA.

“It’s been really, really hard to see some of these clients come into the office and they’re literally in tears,” said Ferreira, founder of Advize Agenci Group, a tax services firm in Hamilton.

“All we could do is help them fight the system.”

Ferreira says two of the cases involved the CRA mistakenly doubling clients’ income slips on 2023 tax returns. One took 18 months to resolve, and she says the other has remained unresolved for more than a year.

“If we as taxpayers have the obligation of filing on time and doing what we’re supposed to do, can the revenue agency have the obligation to the taxpayers to do the same?”

CRA response

In an email to Go Public, the CRA blamed the service delays on a surge in demand, fuelled by factors like a growing population and new tax benefits and programs.

The Union of Taxation Employees, which represents CRA workers, argues the agency exacerbated the problem by slashing jobs.

Marc Brière, the union’s national president, says that since March 2024, the agency has eliminated 11,000 of its 62,000 positions. He says staff reductions include 452 employees in the appeals branch whose contracts weren’t renewed last year.

“We warned them of the impact it would have,” said Brière. “It obviously made the situation worse and they acknowledged that.”

The CRA did not confirm or comment on the job cuts data. But the agency says it’s committed to reducing processing delays through streamlining, modernization and hiring more staff.

The auditor general heavily criticized the Canada Revenue Agency in a new report, saying it’s taking far too long for callers to speak to an agent, and when they do, they’re often given inaccurate information. The federal government says it’s working through a 100-day plan to improve service and is already seeing results.

On Wednesday, the CRA confirmed it has begun the process of rehiring workers within the appeals branch. It also said it’s extending some employee contracts and contemplating new hires within the branch.

“The CRA got the message that they had reached rock bottom and we need to go back up and give better service,” said Brière.

Last year, the CRA fielded complaints about long wait times to reach an agent by phone. The agency says it has taken steps to address this problem as well.

Delays for disability tax credits

Christine Giles of Halifax is also caught up in the CRA backlog.

Last July, she won a 10-year battle with the agency to get her 13-year-old daughter approved for the disability tax credit (DTC), dating back to 2014.

Giles estimates the CRA now owes her up to $15,000 retroactively — money she can’t access until the agency adjusts several years of her past tax returns. The CRA anticipates the process will take more than seven months.

“I think it’s grossly unfair,” said Giles. “If I owed this money to the CRA, I would be charged interest, they would be coming after me. But … I have to sit down and just wait.”

The CRA’s expected timeframe to process these types of complex tax adjustments is four and a half months, but the agency warns on its website that the current wait could be up to 11 months.

The agency told Giles it targeted a March 2 completion date — seven and a half months from the date she won her case. But Giles says she needs the money now to help cover her daughter’s complex medical needs.

“It’s devastating,” she said. “We have no recourse. There is nothing I can do to make them speed this up for me.”

The CRA did not comment on Giles or Bisson’s tax cases, citing privacy reasons.

Other people approved for the DTC are also enduring long waits for the money they’re owed. In light of this, Canada’s Taxpayers’ Ombudsperson, François Boileau, asked the agency last December to expedite their tax adjustments.

Issues including processing delays “are causing financial strain and unnecessary frustration for vulnerable taxpayers who rely on these tax credits,” Boileau’s office said in a statement.

Several taxpayers interviewed by CBC News say they’ve been trying for months to get a hold of a live agent at the Canada Revenue Agency (CRA) to resolve their issues.

What happens next?

Brière says although the CRA is rehiring workers to ease the backlog, he still has concerns.

He says he hopes those jobs aren’t temporary.

“What I don’t want to see is the CRA rehire people and then in September, or in the fall, let them all go and then be in trouble again.”

Brière also worries about current jobs at the agency.

Finance Canada told CBC News that as part of a major federal government cost-cutting initiative, the CRA is reducing its budget by $235 million over three years. The department said that by streamlining operations, the agency will more than make up for the loss.

Neither Finance Canada nor the CRA addressed a question about future job reductions at the agency.

Submit your story ideas

Go Public is an investigative news segment on CBC-TV, radio and the web.

We tell your stories, shed light on wrongdoing and hold the powers that be accountable.

If you have a story in the public interest, or if you’re an insider with information, contact gopublic@cbc.ca with your name, contact information and a brief summary. All emails are confidential until you decide to Go Public.